The value of any motor vehicle accident claim depends, in part, on what you do immediately after the accident and subsequent to that. Your decisions and actions can seriously impact your claim and the amount of your potential recovery.

The following 12 steps should be taken after any motor vehicle accident, including:

1. Ensure Post-Accident Safety

Safety must always be your first and foremost priority!

Safety must always be your first and foremost priority!

- Stay calm.

- Do not flee! Always stay at the scene of the accident. In California, if someone leaves the scene of an accident without reporting it, it can potentially be considered a “Hit and Run” crime and charged as a felony or misdemeanor. In addition, if someone is injured in the accident, drivers have to provide the injured person with reasonable assistance.

- Remain in your vehicle (unless doing so will place you in danger).

- Never get out of your vehicle on the freeway or in the middle of a busy street or roadway.

- Turn your vehicle’s hazard lights on.

- If you or anyone else suffered injuries, call the paramedics.

- Do not ignore your injuries – even if they seem insignificant. Frequently, very serious injuries may initially appear to be minor.

2. Document and Preserve Evidence

It is crucial that you carefully document everything with respect to your motor vehicle accident. The information, which you collect after your accident will be useful in supporting and proving your claim. The information you gather – will serve as the “ammunition” for your attorney in the subsequent fight on your behalf.

It is crucial that you carefully document everything with respect to your motor vehicle accident. The information, which you collect after your accident will be useful in supporting and proving your claim. The information you gather – will serve as the “ammunition” for your attorney in the subsequent fight on your behalf.

Never leave the scene of your accident until after you have collected as much information as you possibly can! Of course, in some situations (e.g. if you were serious injured and need to be transported by paramedics) it may be impossible for you to stay at the scene. However, if you are physically able to do so, make all efforts to stay as late as possible.

- If you can, never leave the scene before the other driver does. You never know what the other driver may do after you are gone. Never assume that, just because you are honest and law-abiding, everyone is … The other driver may make attempts to manipulate evidence, especially if he or she is at fault in the accident (e.g. moving the position of the vehicle, performing quick repairs and taking photos – to minimize the speed of impact, etc.)

Unless it is absolutely necessary for safety reasons, never move the vehicles involved in the accident until the police arrive! In other words, make every effort to preserve the scene of the accident intact.

Obtain the following information:

- Photographs – use the camera on your phone to take photos of:

- The entire scene of the accident and every minor detail you can capture

- The immediate post-crash position of all involved vehicles

- License plates of all involved vehicles

- The damage to your vehicle

- The damage to the other vehicle

- The damage to any property (e.g. watches, eyeglasses, GPS units, etc.)

- Driver License card of the other driver

- Insurance card of the other driver

- All injuries that are visible at the scene of the accident (including injuries suffered by you, the other driver, and any passengers)

- If you are a rideshare driver (e.g. Uber, Lyft, etc.), take a screenshot of your app showing the exact time, your passenger’s name, and your route.

- Driver and Vehicle Information – with respect to all drivers involved in your accident, obtain:

- Names

- Addresses

- Phone numbers

- Driver License numbers

- License plate numbers

- Insurance information

If the other vehicle was a commercial vehicle (e.g. a truck or bus), make sure you obtain information regarding:

-

- The vehicle’s identifying number (e.g. the Department of Transportation (DOT) number, commercial ID number, etc.)

- The driver’s employee number

- The company name and phone number

- The name and phone number of the commercial vehicle’s owner

- Witness information and statements – besides the occupants of your own vehicle, witnesses can include:

- Drivers or passengers of passing cars

- Pedestrians

- Passengers of other vehicles involved in the crash (especially, if the other vehicle was a bus)

If there any witnesses, speak with them and politely request the following information (if they are willing to provide it):

-

- Names

- Addresses

- Telephone numbers

- E-mail addresses

- Witness statements – never wait to obtain statements from witnesses! Ask them to provide a statement right there at the scene of the accident. You don’t have a computer or printer? That’s okay. It is the substance that matters, not the appearance. Witness statements can be handwritten. If a witness is in a rush, follow up within a day or two and remind about the statement. Your goal is to document witnesses’ accounts of your accident before their recollections fade. One more thing – never forget to ask witnesses to sign their statements.

- Video recordings – always check for any potential video recording of your accident:

- If your vehicle had a dash camera or a similar video-recording device, do not use again it until after the data has been successfully downloaded and backed up (some cameras automatically erase recordings after a certain period of time)

- Look at your surroundings to see if any cameras may have potentially recorded your accident (some buildings are equipped with security surveillance cameras)

- Request that the other driver identify and any video cameras that the other vehicle is equipped with (e.g. it is common for buses to be equipped with cameras)

- Post-accident documentation

- Always obtain a copy of any police report pertaining to your accident.

- Ask your insurance company to provide you with a copy of a property damage valuation.

- If you missed work as a result of the accident, keep a detailed record with respect to the time period(s) of your missed work

- If you incur any out-of-pocket expenses, make sure you carefully document them

3. Never Downplay Your Injuries!

It is a part of human nature to downplay injuries after a motor vehicle accident for multiple reasons:

It is a part of human nature to downplay injuries after a motor vehicle accident for multiple reasons:

- Many victims of motor vehicle accidents initially think that their injuries are not that bad and realize the full extent and seriousness of their injuries much later.

- Some people feel it would be “polite” to downplay their injuries, because they don’t want the other driver to “feel bad”.

- Some accident victims are very altruistic by nature and care about others much more than they care about themselves.

- Others are simply so shocked and overwhelmed that they utter “automatic” responses such as “I’m okay”.

Even if you did not sustain any life-threatening injuries, you do not need paramedics to be called, and you genuinely do not feel any symptoms, never say: “I’m okay”, “I’m fine”, “I feel fine”, etc.

In some cases, it may take hours or even days for symptoms to appear. An accident victim may not feel anything out of the ordinary immediately after the crash, but he or she can subsequently develop signs and symptoms of severe and even catastrophic injuries. For example, crash victims with a subdural hematoma (a slow brain bleeding) – a traumatic brain injury – may be completely asymptomatic for days or even weeks after an accident.

The best and safest approach is to:

- say nothing or

- limit your comments to your precise needs (e.g. “no, an ambulance does not need to be called for me”).

If you underestimate or downplay the seriousness of your injuries, it may end up hurting your subsequent claim. The other driver’s insurance company and defense lawyers will use your statements to discredit your complaints, make you seem as if you are exaggerating your symptoms, and make efforts to avoid compensating you for your injuries.

4. Call the Police! Always …

Always call 911, even if:

Always call 911, even if:

- It seems to you that the accident was very minor.

- The other driver seems to admit fault and says he or she is sorry for causing the accident.

- The other driver says he or she is “in a rush” and wants to leave the scene of the accident.

- The other driver says: “let’s not call the police” and/or offers a “gentlemen’s agreement” to handle the issues without any police involvement. In fact, if the other driver is attempting to talk you out of calling the police – this alone should make you call 911. Most likely, this driver realizes his or her fault, and does not want the police to document it in a report. This driver may not even carry any insurance at all. Do not enter into any “gentlemen’s agreements”. Do what is in your best interest – just call 911!

When the police officers arrive, make sure you accurately report all details pertaining to the accident and confirm that a police report will be generated and filed. Subsequently, your attorney will be able to use the police report in order to prove your claim. Finally, do not forget to make notes documenting the names and badge numbers of the police officers who arrived at the scene of your accident.

5. Never Admit Fault! Ever … EVER …

One of the biggest mistakes you can make after a motor vehicle accident is to say “it’s my fault.” This includes not only explicit admissions but also “apologetic” statements such as “I am so sorry” or “this should not have happened”. No matter who you are talking to – the other driver, a witness, a police officer, an insurance adjustor, anyone – never accept or admit fault for the accident, even if:

One of the biggest mistakes you can make after a motor vehicle accident is to say “it’s my fault.” This includes not only explicit admissions but also “apologetic” statements such as “I am so sorry” or “this should not have happened”. No matter who you are talking to – the other driver, a witness, a police officer, an insurance adjustor, anyone – never accept or admit fault for the accident, even if:

- You genuinely feel that it was your fault in causing the accident. Although it might seem obvious that you are the driver who should be blamed for the crash, still, you do not have to and should not admit fault at the scene of the accident. Fault analysis is a complicated process, which involves multiple factors. The determination of fault should be left for experts to be figured out. In fact, it may turn out that you acted completely reasonably and that the accident was not your fault at all. For example, you may think that you were rear-ended because you applied brakes too abruptly but, in reality, the true driver at fault is the one who hit you because he or she did not maintain a reasonable distance. In other words, do not rush to conclusions and blame yourself, especially if that may not be true. Once you admit fault, this will be very difficult, if not impossible, to “undo” and it may severely hurt your chances of prevailing on a claim.

- The other driver is angrily blaming you for causing the accident. Just because the other driver seems to think that you are at fault, it does not make it true. Do not let the other driver pressure, intimidate or force you to admit fault!

- You are giving a statement to a police officer. You have to be truthful and accurate, obviously, but you do not have to admit fault. It is best to “stick to the facts”. To the best of your recollection, explain to the police officer what happened and avoid expressing any “opinions” regarding fault. Never explicitly admit fault or make statements that could later be interpreted as an admission of fault (e.g. “I should have slowed down”). Remember, any admission of fault to a police officer will make its way into the police report, and it can be used against you in case you make a claim for your injuries or another driver makes a claim against you.

6. Never Volunteer Extra Information to the Insurance Company

Providing too much information to an insurance company – whether it is your own insurance company or the other driver’s insurance carrier – is never a good idea. In fact, it can completely destroy your chances of obtaining a recovery. Never blindly trust insurance companies. Insurance companies’ main purpose is – to make money! Insurance adjusters are not your friends – no matter how nice they may seem when you talk to them on the phone. Adjusters’ job is to make sure the insurance company spends less money. How can it be done? Insurance companies save money by denying claims and paying less than the claims’ full value.

Providing too much information to an insurance company – whether it is your own insurance company or the other driver’s insurance carrier – is never a good idea. In fact, it can completely destroy your chances of obtaining a recovery. Never blindly trust insurance companies. Insurance companies’ main purpose is – to make money! Insurance adjusters are not your friends – no matter how nice they may seem when you talk to them on the phone. Adjusters’ job is to make sure the insurance company spends less money. How can it be done? Insurance companies save money by denying claims and paying less than the claims’ full value.

Your Own Insurance Company

You have a contractual agreement with your insurance company. Your primary obligation under that agreement is to make a report to your insurance carrier about your accident. However, by law, you only have to provide basic information pertaining to the facts and circumstances of the accident. Once you have provided that basic information, you have fulfilled your obligation. Never volunteer too much information – even if this is your own insurance company.

The Other Driver’s Insurance Company

You do not have any contract with the other driver’s insurance company. Therefore, you do not have an obligation to provide even the very basic information regarding your accident. In fact, by law, you do not have to speak with anyone from the other driver’s insurance company at all. You have the right to and, in most cases, should refuse to speak with the adjuster or another representative from the other driver’s insurance carrier. This is especially true if you have someone who can speak on your behalf – i.e. an attorney or your own insurance company’s adjuster. However, if you do speak with the other driver’s insurance adjuster, make sure you follow these guidelines:

- Remember – this insurance company has its profits, not your best interest, in mind. It wants to either (1) deny the claim entirely by finding you to be at fault or (2) pay as little as possible.

- Provide only basic information.

- Never allow the insurance company to intimidate or pressure you to provide more information.

- Only answer the questions that are asked – never volunteer information.

- Do not admit fault under any circumstances.

- Do not express any opinions about fault or liability.

- Do not discuss your injuries or how you feel.

- Do not agree to provide a recorded statement!

The best strategy is always to have an experienced personal injury lawyer, such as Cherepinskiy Law Firm, to engage in all communications with insurance companies on your behalf.

7. If You Were Injured – Obtain Medical Care

At the scene of the accident, always inform paramedics about all your symptoms, even if your symptoms seem insignificant or minor to you. Initially, many serious injuries may not produce any symptoms. However, if a serious injury is left undiagnosed and untreated, it may lead to catastrophic consequences. Do not make the mistake of underestimating your injuries, and never neglect your health.

At the scene of the accident, always inform paramedics about all your symptoms, even if your symptoms seem insignificant or minor to you. Initially, many serious injuries may not produce any symptoms. However, if a serious injury is left undiagnosed and untreated, it may lead to catastrophic consequences. Do not make the mistake of underestimating your injuries, and never neglect your health.

If your injuries are apparent, serious, and need immediate attention, go to the emergency room (ER). Even if you feel your relatively minor injuries “can wait” a day or two – do not delay seeking medical care! Make an appointment to see a physician either on the day of your accident or the day after, at the latest. Do not assume that your injuries will resolve without any treatment. Do not take that risk! Let healthcare providers evaluate you and make an assessment with respect to your condition.

Another significant reason for seeking medical care not only in connection with serious injuries, but also with respect to relatively minor injuries is – documentation. Many insurance companies adhere to the “if it’s not written down, then it didn’t happen” principle. Without medical records that carefully document your injuries, treatment, and prognosis – it will be very difficult, if not impossible, for your attorney to prove your claim. Claims that are supported with detailed medical records, typically, result in higher levels of compensation than poorly documented claims.

8. Never Accept “Quick Settlement” Proposals

An adjuster from the other driver’s insurance company may call you and offer a quick settlement, because the insurance company wants to “help you move on with your life”. Rest assured, by settling early, the insurance company wants to help itself – not you. The insurance company is in the business of making money. In handling your claim, the insurance company wants to save as much money as it possibly can. The insurance carrier is counting on you to accept that quick and early settlement, so that it can maximize its profits. When you enter into a quick settlement, the party that will benefit from it will be – your insurance company.

An adjuster from the other driver’s insurance company may call you and offer a quick settlement, because the insurance company wants to “help you move on with your life”. Rest assured, by settling early, the insurance company wants to help itself – not you. The insurance company is in the business of making money. In handling your claim, the insurance company wants to save as much money as it possibly can. The insurance carrier is counting on you to accept that quick and early settlement, so that it can maximize its profits. When you enter into a quick settlement, the party that will benefit from it will be – your insurance company.

A quick settlement may sound tempting because it provides an easy opportunity to pay for the initial medical invoices. However, entering into a quick settlement is a bad idea. Quick settlements are always lower – much lower – than the full value of your claim! When the case settles, you will have to sign a full release of liability. Based on that release, you cannot reopen the case or file a complaint in court based on the same accident, even if it later turns out that the money you received is not enough to compensate you for the cost of medical care and your lost earnings. This means that, once the settlement is finalized and you receive your settlement check, the case is closed forever, even if:

- It takes a much longer time for you to recover than you initially anticipated;

- Your injuries turn out to be significantly more serious than they seemed initially, requiring you to undergo lengthy and expensive treatments that include pain management, physical therapy or perhaps even a surgery;

- You end up missing work for a long time; or

- You lose your job because of the injuries and the treatments, and your condition is so disabling that you cannot work in the same capacity anymore.

The “speed” of the settlement has a price – you will settle for less money than you are entitled to. Motor vehicle accidents can result in a financial hardship. Suddenly, you have to deal with missed work and the cost of medical care. A quick and low settlement may sound like a perfect solution to these problems. Later, you may realize that it was mistake; however, it will be too late to change anything.

Never agree to enter into a quick settlement! If the claim process seems intimidating or too complicated, hire an attorney to handle the claim on your behalf. Statistical data shows that motor vehicle accident victims whose claims are handled by attorneys – receive significantly higher settlement amounts than those victims who make attempts to handle cases by themselves.

9. Never Sign Any Documents for Insurance Companies (Without Talking to an Attorney)

Before you sign any documents or forms that an insurance company asks you to sign, always talk to a lawyer first. Otherwise, you are taking a huge risk that you will either (1) hurt your claim or (2) completely lose your legal rights related to the claim.

Before you sign any documents or forms that an insurance company asks you to sign, always talk to a lawyer first. Otherwise, you are taking a huge risk that you will either (1) hurt your claim or (2) completely lose your legal rights related to the claim.

Authorizations for Release of Medical Information

Victims of motor vehicle accidents should not sign medical authorization forms for insurance companies. When you sign an authorization, you give the insurance company your permission to go on a “fishing expedition” and review your entire medical history. When an insurance company has such a broad access to your medical history, it may see medical information that is completely unrelated to your accident and the claim you are making.

Let’s say you had a prior injury many years before the current accident. The injury has long since healed and, before your recent accident, you had absolutely no symptoms related to that old injury. The insurance carrier may still make efforts to argue that all current complaints and injuries are “pre-existing” – i.e. your injuries were not caused by the recent accident.

If the requests for medical authorizations are made when you have a personal injury attorney by your side, your attorney will have tools to control and limit such requests. However, when an insurance company approaches you with such requests before you had a chance to retain a lawyer, signing authorizations may end up damaging your claim.

Releases of Claims

It is always a bad idea to sign any release without an attorney reviewing it! Whenever you settle a claim, partially or completely, before you receive the settlement check – you have to sign a release agreement. Typically, such documents are called “Release of All Claims”. By signing the release agreement for a party, you release that party from any future claims arising out of the same facts. In other words, when you receive money to compensate you for certain damages, you agree in writing that you will never make any attempts to assert another claim against the same person/entity for the same damages.

Signing release agreements on your own is extremely dangerous! Some “tricky” release agreements are so broad that they – intentionally or unintentionally – make you waive additional legal rights. There are some examples:

- An insurance company wants to settle the “property damage” part of your claim right away, so that you can have your vehicle repaired and back on the road as soon as possible. This partial settlement pertains only to the claims related to your vehicle; not the injuries you sustained in the accident. After the insurance company pays for the repairs, you still have the right to make a claim for your injuries. The release agreement, however, may contain language saying that you are waiving “any and all claims, including claims for property damage and personal injuries”. If you sign this document, you will lose your legal right to pursue a personal injury claim – even though the settlement check will not include a single penny compensating you for your injuries.

- Some cases involve more than one party who is at fault. When you settle with one defendant, you have the right to pursue claims against any other defendant. However, an overbroad release agreement may contain language saying that you are waiving “any claims against any individual or business entity”. If you sign it, you will lose your legal right to make a claim against any defendant – not just the one who is settling the case with you.

Whenever any insurance company wants you to sign something – you must be extremely cautious. Even your own insurance carrier is not exactly your “friend”, let alone the insurance company for the other driver.

10. Limit Your Use of Social Media

Social media – including Facebook, Instagram, and Twitter – is a powerful tool, which can be used to ruin your credibility. Insurance companies and defense attorneys (if the case proceeds to litigation) will comb through your social media profiles searching for any post, comment, update, or photograph that could be used to discredit your claims. Remember, any social media content, even the most innocent and irrelevant to your claim, may end up being misinterpreted, twisted, and otherwise used against you in arguing that your injuries are minor and that the accident had no adverse effect on your life.

Social media – including Facebook, Instagram, and Twitter – is a powerful tool, which can be used to ruin your credibility. Insurance companies and defense attorneys (if the case proceeds to litigation) will comb through your social media profiles searching for any post, comment, update, or photograph that could be used to discredit your claims. Remember, any social media content, even the most innocent and irrelevant to your claim, may end up being misinterpreted, twisted, and otherwise used against you in arguing that your injuries are minor and that the accident had no adverse effect on your life.

After your accident, the best strategy is to temporarily disactivate all your social medial profiles. You can always reactive them after your case is resolved. If you choose to continue using social media, exercise caution as follows:

- Limit your use of social media to “browsing” other people’s profiles and timelines.

- Do not make any posts, comments, or updates that could be even remotely related to your accident, injuries, health condition, etc. Specifically,

- avoid commenting on:

- the circumstances of the accident;

- the issue of fault in your accident;

- any aspect of your health, including your injuries, medical condition, whether or not you are feeling better, your treatment progress, etc.;

- any issues related to your personal life, including work, family, activities, vacations, and hobbies.

- Do not post or publish any post-accident photographs of yourself, especially photographs showing parties, vacations and trips, as well as participation in hobbies and recreational activities.

11. Never Handle Injury Claims By Yourself

Victims of motor vehicle accidents may wonder: “Do I need an attorney?” If you were not injured in the accident at all, you may not need any legal assistance. However, if you or a loved one suffered an injury in the accident, or another driver’s carelessness caused a loved one’s wrongful death, it will be significantly more difficult and challenging to pursue the claim without a lawyer. Personal injury matters, including motor vehicle accident claims, can be very complex.

Victims of motor vehicle accidents may wonder: “Do I need an attorney?” If you were not injured in the accident at all, you may not need any legal assistance. However, if you or a loved one suffered an injury in the accident, or another driver’s carelessness caused a loved one’s wrongful death, it will be significantly more difficult and challenging to pursue the claim without a lawyer. Personal injury matters, including motor vehicle accident claims, can be very complex.

In addition to pain and suffering you suffered as a result of the accident, you may be entitled to be compensated for the cost of medical care as well as the loss of earnings. A detailed discussion of the recoverable damages is included on the Personal Injury Damages page of this website. Insurance companies have unlimited resources, and they will hire aggressive lawyers who will do everything in their power to minimize the amount of money you receive.

Statistical data demonstrates that accident victims, who retain attorneys to handle their claims, receive over three times more money than those victims who attempt to handle cases on their own. Having an attorney by your side can maximize your chances of obtaining an adequate compensation. If you have any questions about your claim, please call or fill out an electronic contact form today to request a free consultation.

12. Act Fast! Don’t Delay

There are multiple reasons why you should never wait too long after a motor vehicle accident. If you do not take action fast, the following adverse consequences can occur:

There are multiple reasons why you should never wait too long after a motor vehicle accident. If you do not take action fast, the following adverse consequences can occur:

- The statute of limitations may expire, which will completely eliminate all your rights to make a claim for compensation. In California, generally, the statute of limitations for personal injury claims involving motor vehicle accidents is 2 years. However, in some cases, the deadline may be earlier than 2 years. For example, claims against Governmental agencies may have to be filed as early as 6 months after an accident.

- Significant evidence may become unavailable:

- witnesses’ memories may fade;

- photographs may be lost or destroyed;

- video surveillance data may get erased or replaced with newer recordings;

- documents may get shredded pursuant to a company’s periodic document destruction policy;

- e-mails and text messages may be erased;

- mobile phones containing crucial evidence may get lost, destroyed, or simply replaced with newer devices; and

- other vehicles involved in the accident may get repaired, repainted, or sold.

- If you do not seek timely medical care for your injuries: (1) your injuries may worsen or even become life-threatening and (2) you will jeopardize your claim because your injuries will not be documented by healthcare professionals, and defendants will claim that something else must have caused your injuries.

- For all of the above reasons, attorneys may be reluctant to take on a case, where nothing has been done for a long time.

Your likelihood of obtaining a successful recovery depends on how fast you act after your accident. The sooner you take steps to initiate and advance your claim – the better. Don’t delay! If you have been in a motor vehicle accident, you should discuss your claim with an attorney as soon as possible.

Obtain a Free Consultation

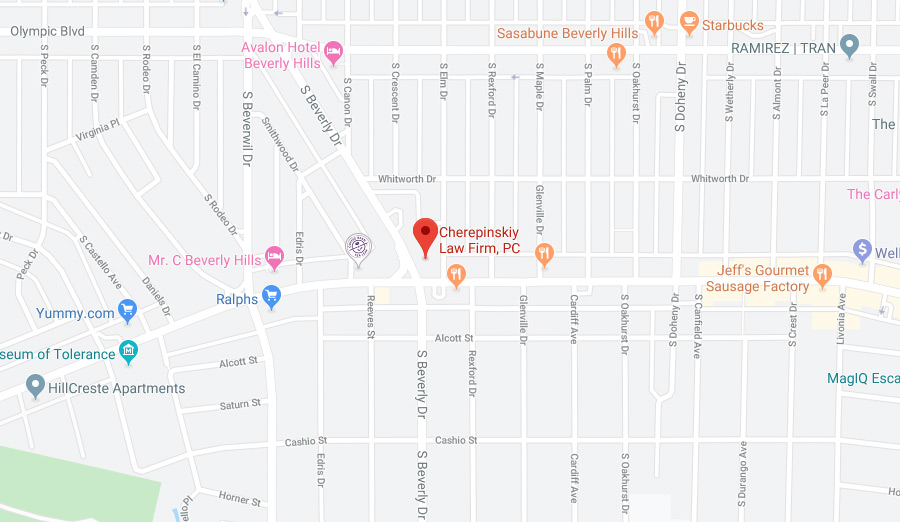

If you believe another driver’s carelessness caused your injuries or a loved one’s death, please call (310) 694-0317 or fill out an electronic contact form today to request a free consultation. Cherepinskiy Law Firm, as a premier and highly experienced motor vehicle accident law firm, will work in a tireless and compassionate manner to make sure you are compensated for your injuries and losses.